ROI Acronyms that Marketers Need to Know in 2020

Sometimes it feels like we’re swimming in alphabet soup in the business world. If you aren’t hip to all of the latest acronyms, people might as well be speaking in a foreign language when tossing around shorthand jargon in discussions of marketing ROI.

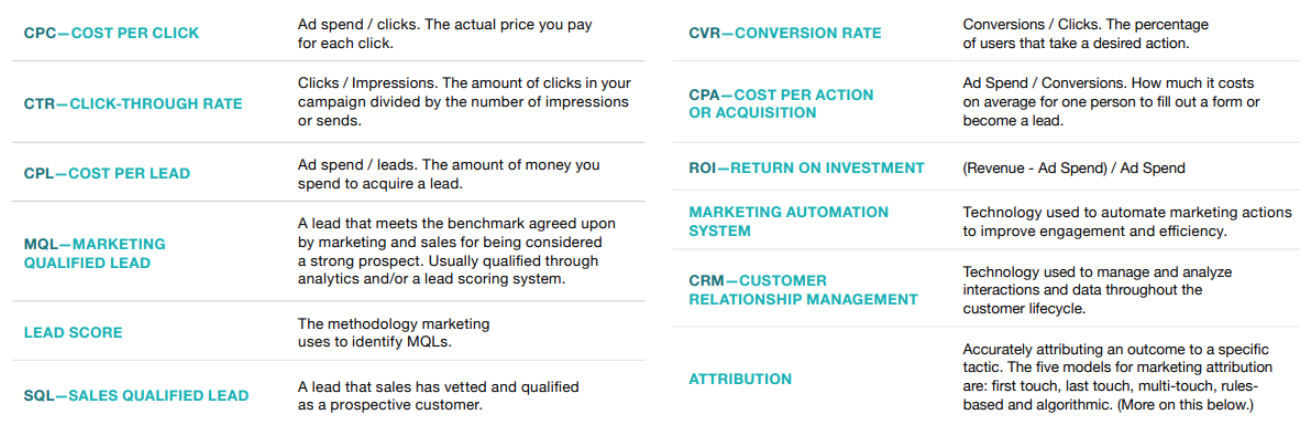

Cutting through the buzzwords and lingo, let’s bring some much-needed clarity to the matter by defining today’s most common acronyms, and why they matter when it comes to understanding and measuring ROI in marketing.

What Is ROI in Marketing?

Developing a marketing strategy requires us to first determine how much we’ll be budgeting for a campaign or initiative, and then figure out how to allocate that spend across various channels and tactics. You’ll only know how well your strategy paid off by calculating the return on your investment. Doing so helps us understand – and prove – the impact of marketing on the business, while also giving us insight into where we should focus spend going forward.

The trick is to understand all of the ROI acronyms and formulas, as well as how and when to apply them. Here are key ROI metrics you should know.

CAC—Customer Acquisition Cost

You’re going to invest in many tactics to generate leads that ultimately convert to customers. The more efficiently you can help your company acquire customers, the more profitable your company will be. That’s why CAC is a key metric to guide your marketing investments: [All Marketing Costs Spent Acquiring Customers / Number of Customers Acquired]

Keep those costs low and the number of customers high, and you’ve got a winning formula.

CLV—Customer Lifetime Value

Customer Lifetime Value is a calculation that everyone across the business should understand. In fact, some would argue it’s the ultimate ROI metric, as it defines the projected revenue and profit your company will realize from any given customer in full.

For subscription-based services, the calculation is: [Average Length of Subscription x Monthly Cost of Subscription]

For products and services you’ve been selling for some time, you can come up with averages: [Average Monthly Revenue Per Customer x Average # of Months a Customer Stays With Your Company]

KISSmetrics produced an infographic explaining how to calculate lifetime value for less predictable services.

CPC—Cost Per Click

This is defined as the actual price you pay for each click on your ad. You calculate this by dividing your ad spend by your clicks: [Ad Spend / Clicks]

A successful CPC equates to low cost for a high number of clicks. Keep in mind that for CPC, you’re focusing only on what happens with your ad, which can give you a false sense of ROI. This metric won’t give you the full story in terms of how these clicks ultimately contribute to your company’s strategic business goals (i.e., revenue).

CTR—Click-Through Rate

Click-through rate is the number of clicks in your campaign divided by the number of impressions or deliveries: [Clicks / Impressions]

Just like CPC, this measurement on its own can be misleading. LinkedIn research shows 80% of marketers report on CTR, even though this method doesn’t properly gauge business impact. While a vanity metric like CTR is simple and familiar, even a million clicks are meaningless unless they help your company generate revenue.

CPA—Cost Per Action or Acquisition

With CPA, you calculate how much it costs on average for one person to fill out a form or become a lead using the formula: [Ad Spend / Conversions]

To be meaningful, your CPA needs to show the payoff of your efforts in the form of a significant return on investment. Remember: low-quality leads are a waste of marketing spend and sales resources required to qualify (or rather disqualify) them.

CPL—Cost Per Lead

Just as it says, this metric determines the amount of money you spend to acquire a lead: [Ad Spend / Leads]

As with CPC and CTR, CPL is not especially meaningful on its own. If you look at CPL in a vacuum – without also looking at value per lead – then you’re missing the most important part of the ROI formula. You need to know the rate at which those leads convert into closed deals, and the amount of revenue those deals added up to. My measuring these factors comprehensively, you won’t fall into the trap of focusing on quantity over quality and emphasizing cost over ROI.

CPO—Cost Per Opportunity

This is a different – and more accurate – way of looking at CPL, measuring the cost of leads that the sales team deems worthy of pursuing. An opportunity is not only qualified by the sales team, but has shown intent to purchase (making it more valuable than a lead). As with CPL, you ultimately want to know how many opportunities convert into closed deals and the amount of revenue associated with those converted opportunities.

CVR—Conversion Rate

This is the percentage of users that take a desired action calculated as: [Conversions / Clicks]

The higher the CVR, the better. That said, this is best paired with cost per conversion, which is the dollar amount you spend to acquire a conversion through a campaign. A low cost per conversion and a high conversion rate equates to a higher return on your marketing investment.

LVR—Lead Velocity Rate

This indicates how quickly leads move through the pipeline (which is why it’s also referred to as Pipeline Velocity Rate). The faster your leads turn into paying customers, the better for your company – it shows you are delivering high-quality leads that your sales team can quickly convert to a closed deal.

To calculate this, you need timestamps associated with leads as they progress through the stages you track in your systems of record. You will need to coordinate with the sales team to get a full view of a lead’s movement from the initial to final stages, but it’s well worth your while. Understanding LVR helps you tweak your processes and tactics to generate revenue more efficiently.

NPS—Net Promoter Score

As a growing number of companies emphasize customer retention, they are embracing the NPS metric, which is a way to measure customer satisfaction and get a baseline for the health of a customer retention program.

You measure NPS by asking your customers one question: “On a scale of one to ten, how likely would you be to recommend (our brand) to someone else?” Those who respond with a nine or a ten are considered Promoters — loyal customers who will provide repeat business and referrals. Sevens and eights are Passive: They’re satisfied customers but not enthusiastic, so they are just as likely to go with a competitor come renewal time. Anyone under seven is considered a Detractor – an unhappy customer who can actively damage your brand.

To calculate your NPS, subtract the percentage of Detractors from the percentage of Promoters: [Promoters – Detractors.]

ROI—Return on Investment

As a marketer, you need to understand the impact of your marketing programs in terms of the return on your investments. You can calculate this for your brand marketing (driving awareness), acquisition marketing (adding new customers), and customer marketing (retaining existing customers). In many organizations, the largest percentage of marketing dollars are spent on acquisition marketing, which makes it vital to master the complexities of calculating ROI “beyond the click” to actual revenue. The ROI calculation for that is: [Revenue – Spend]

RPL—Revenue Per Lead

At the end of the day, the truly telling metric is revenue per lead, usually calculated as revenue attributed to leads within a certain time frame: [Revenue Generated / Number of Leads]

RPL is closely tied to CLV, as you want to understand how much revenue you’ll generate from each lead and, ultimately, each customer.

When it comes to measuring your marketing ROI, it’s helpful to master many formulas. Just don’t let all those calculations cloud your perception of what ultimately matters. Though you’ll want to calculate your results every step of the way, the bottom-funnel metrics are the ones that matter most. In other words, vanity and reach metrics should take a backseat to those measuring true business impact. Embrace this philosophy to earn more credibility with the C-suite and secure more budget as you prove the true value of marketing on the business.

For more on how to calculate and optimize your marketing ROI, download our eBook:Solving for Marketing ROI.

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.